are inherited annuity payments taxable

You have the option of taking a lump sum payment from an inherited annuity if there is any money left over. Inherited annuities like any other sort of income are taxable.

Annuity Beneficiaries Inheriting An Annuity After Death

At the time you receive the benefits youll have to pay any taxes that are payable.

. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. But annuities purchased with a Roth. At the time you receive the benefits youll have to pay any taxes that are payable.

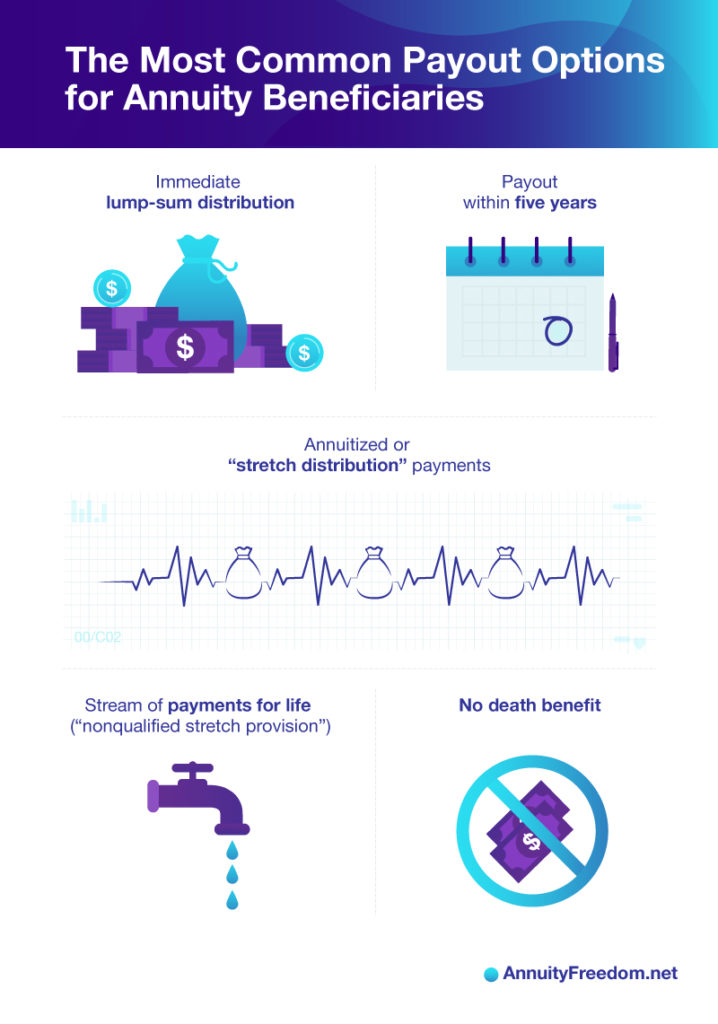

Although you will not owe taxes on the principal or the amount your father paid into the annuity you will owe taxes on the interest the premium has earned. Inherited Annuity Tax Implications. Tax-deferred annuity beneficiaries can pick from a variety of payment alternatives that will affect how the income benefit is taxed.

Ad Learn More about How Annuities Work from Fidelity. However how the taxes add up depends on the beneficiary and how the annuity has been structured. Consider the case where you.

Do I have to pay taxes on an inherited annuity. As a result inherited annuities are subject to tax. So if you were the.

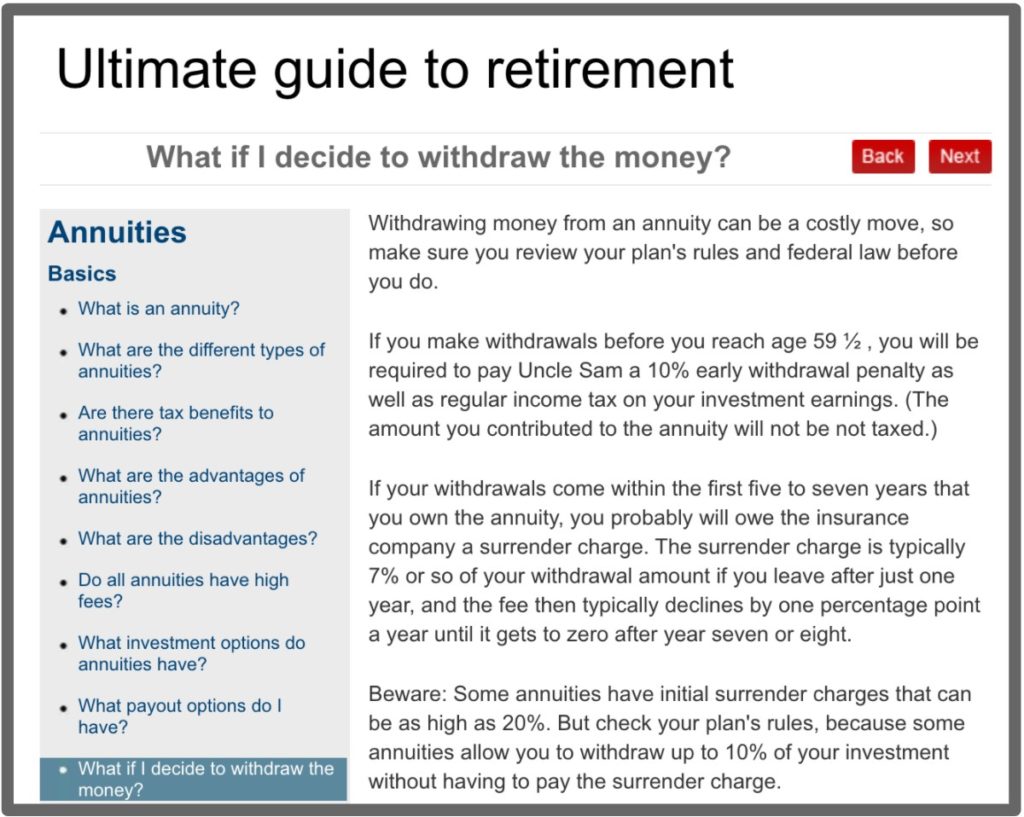

The exact amount of the payment that is taxable will vary depending on many factors. Any beneficiary including spouses can choose to take a one-time lump sum payout. All inheritable nonqualified annuities.

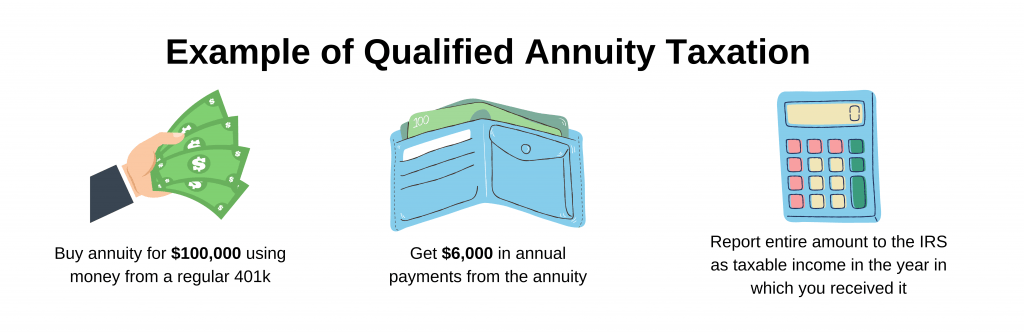

Is an inherited annuity taxed as ordinary income. In this case taxes are owed on the entire difference between what the original owner. Typically all inheritable qualified annuities usually IRA annuities are subject to income taxes 100 of the assets.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. Is inherited annuity taxable.

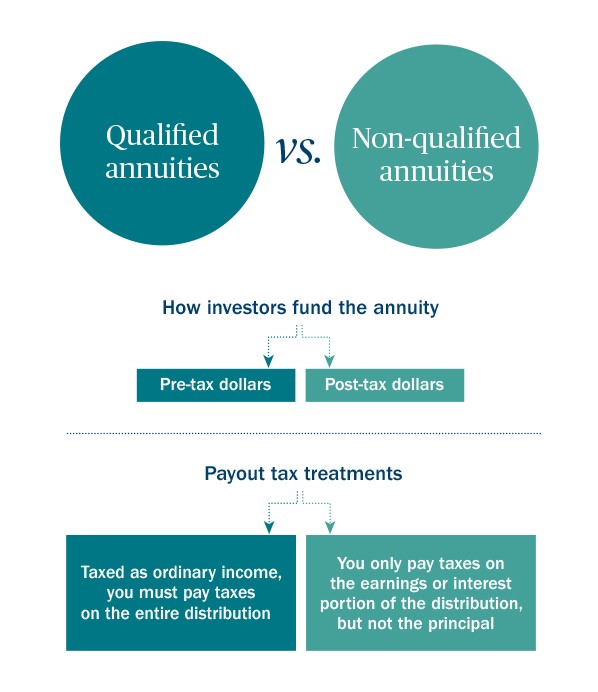

Thats because no taxes have been paid on that money. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. Inheritance Taxes on Annuity Benefits Pre-tax dollars are used to fund qualifying annuities.

The part of the annuity payment representing return of capital is not taxable but the earnings are. The date of the tax event is determined on the payout structure and your beneficiary status. Because the owner never paid any taxes on the.

When you receive payments from a qualified annuity those payments are fully taxable as income. A nonqualified annuity which is an annuity not associated with an employer-provided plan or an Individual Retirement Account is generally purchased with an after-tax lump-sum investment. The inherited annuitys remaining funds can be withdrawn in a single payment if desired.

Ad Learn More about How Annuities Work from Fidelity. It is possible to pay. Although contributions to a non-qualified annuity are not taxable growth and earnings on the initial investment are tax-deferred.

Theres a caveat though. Some portion of the annuity is generally taxable to you.

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Beneficiaries Inheriting An Annuity After Death

Do You Pay Federal Taxes On Annuity

How Are Annuities Taxed Menafn Com

Taxation Of Annuities Explained Annuity 123

Annuity Taxation How Various Annuities Are Taxed

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Taxation How Various Annuities Are Taxed

Taxation Of Annuities Ameriprise Financial

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Annuity Beneficiaries Inherited Annuities Death

Understanding Annuities And Taxes Mistakes People Make Due

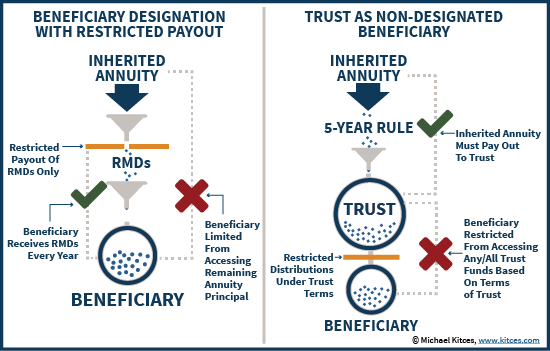

Trust Vs Restricted Payout As Annuity Beneficiary

Inherited Annuity Tax Guide For Beneficiaries

How To Avoid Paying Taxes On An Inherited Annuity Smartasset